HIMS: The Volatile Meme Stock with a Foundation of Value

Disclaimer: I am not a financial advisor. This research is based solely on publicly available financial data and is intended for educational and informational purposes only. It is meant to illustrate the application of financial concepts and ratios. This analysis is not investment advice, and you should always consult with a qualified, registered professional before making any investment decisions.

A Deep Dive into Hims & Hers Health, Inc. (HIMS): Separating Short-Term Noise from Long-Term Opportunity

Hims & Hers Health, Inc. (Ticker: HIMS) has captured the market’s attention as a high-flying, highly shorted, and wildly volatile stock. Yet, beneath the noise of short squeezes and dramatic price swings lies a business model undergoing a fundamental, aggressive, and potentially lucrative transformation. This analysis argues that while HIMS is a risky, volatile security today, its strategic pivot toward vertical integration and profitable scalability makes it a compelling long-term opportunity.

Part I: Quantifying the Short-Term Risk (The Meme Stock Numbers)

The intense debate and volatility surrounding HIMS are quantified by classic “meme stock” metrics. These numbers validate the risk component of my thesis.

1. The High-Risk Beta and Volatility

I quantify the trading risk using the Beta coefficient, a measure of a stock’s systematic risk relative to the overall market.

Beta: Recent analysis, including figures cited by Zacks Investment Research, places HIMS’s Beta around 2.20 (or higher in some short-term reports). This means HIMS is historically 2.2 times more volatile than the broader market, amplifying both gains and losses.

2. Extreme Short Interest

The most direct signal of market contention is the short-selling activity:

Short Interest % of Float: As of the latest reports, the short interest as a percentage of the total tradable shares (float) is approximately 34.03%.

Days to Cover: This metric sits around 3.08 days.

This 34% short interest is extreme and quantifies the massive, high-conviction bearish bet against the company. This creates the structural conditions for a dramatic short squeeze (when the stock price rises, causing short sellers to cover their position and buy back shares), which is the primary source of the stock’s rallies and sharp corrections.

Part II: Strategic & Non-Quantitative Advantages

Beyond the numbers, the long-term case rests on strategic advantages that create a powerful moat in the competitive telehealth space.

Personalized, Multi-Specialty Platform: HIMS has successfully transitioned from being a niche seller of men’s health products to a multi-specialty personalized health platform. The growth is now driven by higher-value, personalized treatments across Weight Loss (GLP-1s), mental health, and women’s health. This shift increases Average Revenue Per User (ARPU) and improves customer retention.

Brand and Destigmatization: HIMS has invested heavily in a bold, direct-to-consumer brand identity that has successfully destigmatized conditions like erectile dysfunction, hair loss, and weight management. This brand loyalty and trust are high barriers to entry for competitors.

AI and Technology Integration: The company leverages Artificial Intelligence tools (like MedMatch) to optimize provider-patient matching and personalize treatment plans. The massive investment in Technology and Development (up 96.73% YoY) is focused on building a scalable digital infrastructure to handle daily visits, increasing the moat over less tech-savvy competitors.

Part III: Leverage and Valuation

The fundamentals prove the business is scaling efficiently, and the valuation metrics suggest a discount relative to its growth trajectory.

1. Operating Leverage Confirmed

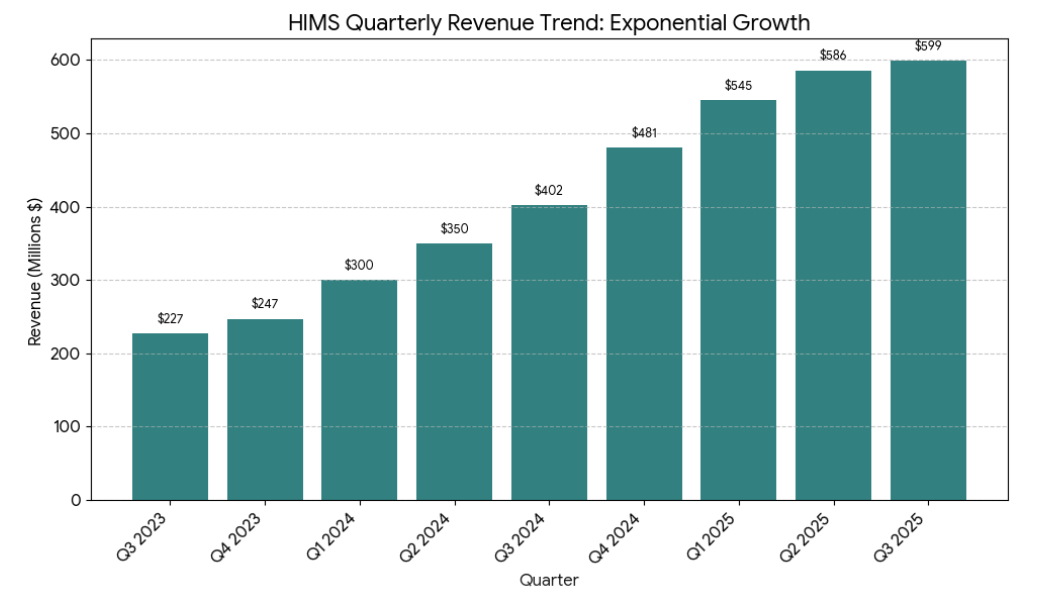

For the nine months ended September 30, the financial data confirms the success of the scale-up:

Revenue Growth (+73.79%) far exceeded Total Operating Expense Growth (+56.85%).

This structural efficiency resulted in Income from Operations soaring by +122.66%.

This operating leverage is a very valuable quantitative argument for the long-term thesis.

2. Vertical Integration and Capital Commitment

The +349.05% spike in Property, Equipment, & Software (Net) and the +113.54% rise in Inventory confirm the strategic pivot to owning the supply chain (e.g., compounding facilities). While this capital investment results in huge short-term volatility (Net Cash Used in Investing Activities was up over 51,000%), it secures long-term cost advantages and quality control.

3. Net Income vs. Operating Cash Flow

A key distinction in evaluating HIMS is the difference between accounting profitability and cash generation:

Net Income for the nine months increased by a modest +7.75% (heavily affected by non-cash, one-time items from the prior year).

However, Net Cash Provided by Operating Activities increased substantially by +44.93%.

This divergence confirms the business is generating significantly more cash than its GAAP Net Income suggests. Cash flow is the true lifeblood of an expanding business, proving the underlying operations are financially robust and self-sustaining.

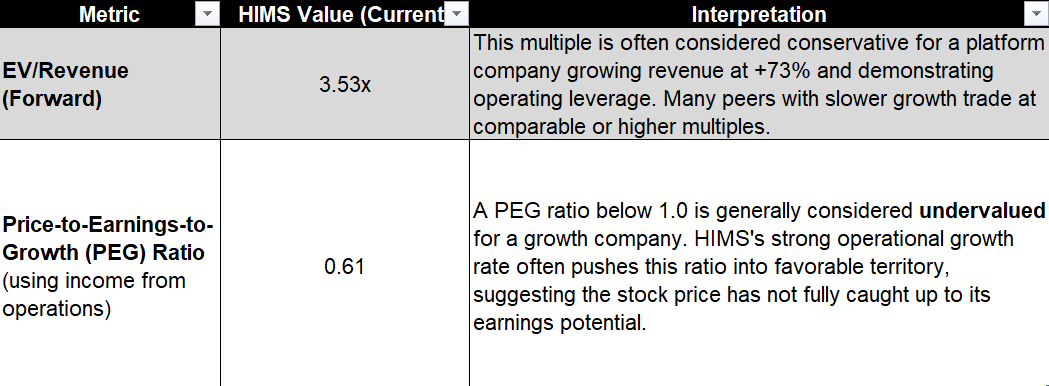

Part IV: Valuation Multiples (The Opportunity)

I analyze the company’s valuation against its phenomenal growth to assess whether the volatility is creating a buying opportunity.

For a high-growth company, the Price-to-Sales (P/S) and Enterprise Value-to-Revenue (EV/R) multiples are key metrics:

Valuation Conclusion: The relative multiples suggest the market is undervaluing HIMS based on its current growth trajectory and the proven scalability of its model. The short-term risk premium required by the market (evidenced by the high Beta is suppressing the stock price, potentially creating a favorable long-term entry point for investors focused on fundamentals.

Final Takeaway

HIMS is a classic high-risk, high-reward stock. The short-term volatility beta of ~2.20 and 34% short interest is the admission price for a company rapidly building a structural moat in the multi-billion-dollar personalized healthcare market. The quantitative fundamentals, including +122% operating income growth and strong operating cash flow, support the belief that the long-term value will eventually overwhelm the short-term noise.